The market is slow but not weak yet. There are still folks running to buy.

Larry Yatter has shown that some market have started dropping.

However nothing much will happen until all assets start to drop..Gold, Stocks and RE. What will be the catalyst? Higher interest rates or a Dubai-like black swan event.

I am heading into hibernation and probably wont put up a post until something changes, which may not be until the New Year.

Saturday, November 28, 2009

Malaysian Life Expectancy

Basically a male Malaysian can expect to live healthily until age 62 and then drag 7 years before dying at age 69. Likewise women may drag 9 un-healthy years in average before passing away. Some people may have planned for their departure. But almost all people forget their lives WILL NOT just END like that. Instead, it will most probably be a .... ... ... kind of ending. You will most probably be causing troubles to yourself, your family or at least to the society! Other than the finance preparation, what else have you done to prepare for your golden years ?Life expectancy at birth : male 69 / female 74

Healthy life expectancy at birth (2003): male 62 / female 65

Probability of dying under five (per 1 000 live births): 12 = 1.2%

Probability of dying between 15 and 60 years m/f (per 1 000 population): male 197 = 19.7% / female 109 = 10.9%

Also don't forget that there are 95% chances that Malaysian will most probably die of health issues. Most probably either your heart or lung will fail you earlier than any other causes ie. less than 5% chances we will be killed in accidents.

Labels:

Insurance

Sunday, November 22, 2009

More Info : invest your EPF money in stock market direclty.

It was mentioned before that you can use your EPF money to invest directly in the stock market, especially through Jupiter and Amara. The main selling points are;

- cheaper than invest to Mutual Fund ( 5.5% ) vs 3% charged by Amara

- freedom to invest in any particular stock and not a whole portfolio.

Although Jupiter only charges 0.1% or minimum RM 10 brokerage fee but actually Amara, the licensed EPF withdrawal facilitator, have more charges other than the 3% one time drawn down fee.

The significant ones are

- Transaction fee : 0.1% or minimum RM 15 per contract

- Custody fee RM 0.005 per 1,000 shares per month

Add together with Jupiter's fee, your total brokerage fee may effectively be at 0.2% or minimum RM 25. So each MOTS (Minimum Optimized Trading Size) is RM 12,500. With RM 25,000 you can only make 2 transactions.

Assuming you fully load all your investment in the market and average price per share is RM 1. Then 25,000 shares /1,000 x 0.5 cent = RM 0.125 every month. 1 year would be RM 1.50. That would be 0.006% of your initial RM 25,000 investment.

At the end, you may still be paying 4-5% fee in the whole process. In contrast to mutual fund's 5.5%. If saving fee is your main target, perhaps becoming a mutual fund agent yourself could end up saving more. On the other hands, most of the EPF oriented mutual funds are charging less fee.

So if EPF gets a 5% return, you should be able to do more than 10% in order to 'invest yourself'. Else you may just be depleting your ASS - Automatic Saving System.

Also be reminded that if you make a lot of transactions, you may end up paying more than 6% fee.

Labels:

Finance Planning,

Mutual Fund,

stocks

Friday, November 20, 2009

You can use Your EPF money to invest in stocks ?

If you have enough money in your EPF, you can withdraw some of them into a stock trading account and invest for yourself. This may interest those who think they are more market savvy than EPF investment. ie. you were NOT happy with EPF past year performances or you think you can do better than them in future.

First of all, depends on what your age is, there is a certain amount of money you have to leave in account 1. After minus out this amount, you can withdraw up to 20% of whatever left in Account 1. However, the fund receiving party may not simply accept any small amount. A common minimum amount to be withdrawn is MYR 30,000.

Together with Amara, Jupiter Online recently has an offer where the minimum amount is lowered to MYR 25,000. This way, more EPF account holder can use their money for this purpose.

Fees being charged are

- One time 3% drawn down fee. ( by Amara )

- 0.1% or MYR 10 brokerage fee ( by Jupiter )

The following table shows how much you need in your Account 1 in your EPF so that you are eligible for this. If you have never withdrawn from your EPF before, Account 1 is 70% of your total EPF.

My advice ? Financially one shouldn't simply withdraw money from his Automatic Saving System. Statistically MOST people do not earn consistently from stock investment. Although many may think they did great but almost certainly they have miss calculated the power of compound saving. Not to mention most investors DO NO even have a systematic trading strategy and plans.

Assume foregoing EPF payout is 5% in average. Withdrawing would minus out 3% from the fund. So you can out perform EPF if you consistently gain 8.1% return. ( where does the extra 0.1% come from ?)

A good stock investor can get 6% to 12% so its still a viable option, especially if you agree with these ...

- calculate return rate from total fund, not the transaction amount

- know it first, then unknown it to counter your emotion challenges

- Minimum Optimized Trading Size

- When to Buy at What Price

- How to earn in ANY market conditions

and perhaps some tools that can help you

- see how the world moves before your market opens @ stock.malpf.com (the story)

- use this tool to calculate price to buy with historical EPS and projected PE

Be reminded that the best investment gurus like Buffet and Benjamin only out perform market by 6.46%, full story here.

Those are just recommendation base on finance and statistic. If you personally hate EPF or simply don't trust them with your money, you probably just want to take all out despite everything else. Keeping your money in the stock broker account usually gives you a slightly lower than Fix Deposit interest anyway.

Labels:

Finance Planning,

stocks

Wednesday, November 18, 2009

New record? Not quite- but close

Rob Chipman has pointed out on his blog how close we are to the record (average) prices of 2008.

Here is his chart:

http://www.robchipman.net/blog/images/AvgPriceGraphs/REBGVAveragePriceGraphOctober2009.pdf

Hard to believe that we would see record prices at a time when the US, our major trading partner, was in such difficulty- when our main exports- natural gas and lumbar are down significantly from a year ago, when major employers are cutting back or closing and even the City and Province are pulling in their horns.

I guess it is the very low rates, the pre-Olympic hype and building boom and.....a sense amongst buyers that they may have already missed the boat and have to dive in regardless of the price.

In any case the market is strong and if it goes much higher then we have to re-evaluate the 'bubble bursting graph' which we have been following so far.

It wold be unusual, compared with other bubbles, if the price bounces straight back higher. As I have said several times, if the prices exceed their previous highs then we have a different ball game.

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiFnvXQvEnPDZvj2jZvn-2LUIy3CDbZNgfw4FIsrEYuaUMdZwo9LoRX1M4JYienfQDiragLrAHWnhrFTrDMi86mqWjOb1ziEsvj9GreoGL4NKOxP4Uh3kUhTzsIV6YWwHqXrLx7YmIPIpX9/s400/bubble-lifecycle.gif

However, I must admit the market 'feels' different from the record prices in late 2007 - early 2008. At that time houses were often selling over list, as buyers panicked to buy. There were less than 20 SFH under $1 Million in West Van, now there is 40.

Sellers are dropping their prices (albeit from high levels and by small increments) quickly. It is as if they think that this could be the sweet spot for sellers and may not last.

The Fraser Valley was nearly as hot as down-town, but after the crash of a year ago, the recovery has been much more muted outside of Vancouver.

Lets wait and see. I posted almost 8 months ago, that the huge drop in interest rates, coupled with the 15-20% drop in prices, had reduced the effective cost of ownership by 35% or more from the peak. Well we have given back most of the price drop.

If and when it does drop again, and the banks and CHMC struggle, unemployment rises...I doubt we will have much money left in the kitty to bail us out:

http://www.debtclock.ca/

Here is his chart:

http://www.robchipman.net/blog/images/AvgPriceGraphs/REBGVAveragePriceGraphOctober2009.pdf

Hard to believe that we would see record prices at a time when the US, our major trading partner, was in such difficulty- when our main exports- natural gas and lumbar are down significantly from a year ago, when major employers are cutting back or closing and even the City and Province are pulling in their horns.

I guess it is the very low rates, the pre-Olympic hype and building boom and.....a sense amongst buyers that they may have already missed the boat and have to dive in regardless of the price.

In any case the market is strong and if it goes much higher then we have to re-evaluate the 'bubble bursting graph' which we have been following so far.

It wold be unusual, compared with other bubbles, if the price bounces straight back higher. As I have said several times, if the prices exceed their previous highs then we have a different ball game.

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiFnvXQvEnPDZvj2jZvn-2LUIy3CDbZNgfw4FIsrEYuaUMdZwo9LoRX1M4JYienfQDiragLrAHWnhrFTrDMi86mqWjOb1ziEsvj9GreoGL4NKOxP4Uh3kUhTzsIV6YWwHqXrLx7YmIPIpX9/s400/bubble-lifecycle.gif

However, I must admit the market 'feels' different from the record prices in late 2007 - early 2008. At that time houses were often selling over list, as buyers panicked to buy. There were less than 20 SFH under $1 Million in West Van, now there is 40.

Sellers are dropping their prices (albeit from high levels and by small increments) quickly. It is as if they think that this could be the sweet spot for sellers and may not last.

The Fraser Valley was nearly as hot as down-town, but after the crash of a year ago, the recovery has been much more muted outside of Vancouver.

Lets wait and see. I posted almost 8 months ago, that the huge drop in interest rates, coupled with the 15-20% drop in prices, had reduced the effective cost of ownership by 35% or more from the peak. Well we have given back most of the price drop.

If and when it does drop again, and the banks and CHMC struggle, unemployment rises...I doubt we will have much money left in the kitty to bail us out:

http://www.debtclock.ca/

Sunday, November 15, 2009

Is Buying New Car the Only Way ?

However buying new car shouldn't be your only way to have your very own transport.

Used Car

You may only get a SMALL NEW car with $40,000+ but you can get a pretty NICE USED car for only $20,000. That is an instant 50% saving !

Borrow

Do you have friends or relatives who have extra cars parking at their homes only being used once in a while ? There was once I drove my uncle's Mercedes for a month and I only paid $800 for it. Last weekend I visited 10 eligible neighbors telling them my car has broke down and I need to borrow their cars for a month. 3 of them are willing to do so for $500.

Car Pooling

Usually people don't car pool and there are many excuses for that. But at the moment I showed some cash, 15% of the drivers suddenly become more friendly. This is especially good for regular trips. As for the weekend get away, I looked for shopping and travel buddies who drive.

What other creative ways you can think of to use your transport money ?

Labels:

case study

Saturday, November 14, 2009

Get ready

I hope those who are feverishly buying right now are:

1) secure in their jobs

2) have taken into account possible increases in taxes.

Vancouver City council is looking at job cuts and increased taxes to try and deal with huge budget short-falls. These job cuts will be in full time City Hall positions and even police and fire-fighter positions. Not good.

http://www.theglobeandmail.com/news/national/british-columbia/job-cuts-likely-option-to-balance-vancouver-budget/article1363298/

http://www.vancouversun.com/news/City+Vancouver+looks+cutting+staff+close+budget+shortfall/2220380/story.html

What happens after the Big corporate party/ Nationalistic medal struggle AKA the Olympics? What sort of shape will the Provincial and City budgets be in then??

Don't expect to find out until well after the Olympics. You will remember how we had a projected balanced and then a small deficit from the Provincial Government until AFTER the election, when the truth about the deficit emerged.

..................................................

1) secure in their jobs

2) have taken into account possible increases in taxes.

Vancouver City council is looking at job cuts and increased taxes to try and deal with huge budget short-falls. These job cuts will be in full time City Hall positions and even police and fire-fighter positions. Not good.

http://www.theglobeandmail.com/news/national/british-columbia/job-cuts-likely-option-to-balance-vancouver-budget/article1363298/

http://www.vancouversun.com/news/City+Vancouver+looks+cutting+staff+close+budget+shortfall/2220380/story.html

What happens after the Big corporate party/ Nationalistic medal struggle AKA the Olympics? What sort of shape will the Provincial and City budgets be in then??

Don't expect to find out until well after the Olympics. You will remember how we had a projected balanced and then a small deficit from the Provincial Government until AFTER the election, when the truth about the deficit emerged.

..................................................

BTW if the answer to 1) and 2) above is no...or not sure, then at least make sure you have a CHMC insured mortgage so we can all be on the hook when you walk...

Thursday, November 12, 2009

Govt. goes public - Don't subsidize the RM50 !

It was hinted before that government may try to stop banks to subsidize credit card users on the RM50 fee to be enforced by the government starting next year.

Today its no longer an internal warnings between government and banks. Government has made it public in the news on this. But of course it was made in a polite way,

if banks subsidize our RM 50

we will FAIL to reduce

Credit Card Debt problem !

Actually following one of the latest sharing commented by Alan in last post, banks faced many rejections on the ideas they proposed to bank negara. But BNM has no control whatsoever on the points accumulated in your credit cards. So when banks use the point system to return the RM 50 value to the credit card users, government fail to stop that approach. Hence, government goes public with news to add public social pressure to the banks.

Its interesting to see how politic and finance fight so fierce over our precious RM 50.

I am predicting the next move from bank is introducing 1Card - use ONE bank's credit card as to replace ALL other banks' card. Such Credit Card will have combined limit of all your other cards. The trouble they are facing now is to combine all the rebates offers because each bank only have contracts with certain retailers.

Imagine a Card that you can swipe up to $200,000 !! You can buy a house instantly with a plastic !!

Labels:

case study,

credit card

Tuesday, November 10, 2009

How much should we buy that car ?

First lets start with some facts of transport life around me;

- Taxi is as good as my own car if not better ( its my own car + a driver ) but its costly

- Bus stations are near by and can go almost anywhere but it takes too much of my precious time

- Intra city trains are fast and efficient but only after you are IN the city

- Car rental gives the highest flexibility but it could be expensive if park aside too long

So I will need a hybrid solution if I don't have my own car. For me, I will use Taxi - Train - Light Rail during normal days and Bus and Car Rental during weekend and holidays.

First I take a taxi to the near by train station (KTM), once in town I use light rails ( PUTRA, STAR, MONORAIL etc.) to travel almost anywhere within the city. Typically I would need to exchange once within the light rail systems to reach my destination. Return trip same path.

$8 : Taxi to station$1.40 : Train to Town$1.80 x 2 : Light rails within cityOne way = $13Return or one day = $265 days week = $13050 weeks a year = $6,500

By weekend, I would rent a car and run away for 2 days ...

$180 / day x 2 days = $3604 weeks or 1 month = $1,44012 months or 1 year = $17,280

Adding both up is $23,780 a year.

If $2,000 a month of transportation fee seems ridiculously high, you probably do not need to rent a car every weekend, perhaps every bi-weekly or even every month if at all needed. Run your own numbers for your own scenarios. This example is trying to mimic the same lifestyle with a car.

Now if I do all that with my own car, I would need to pay for

- petrol : $400 a month

- parking : $10 / day x 5 days x 4 weeks = $200 a month

- maintainence : $100 a month

That is a total of $700 a month burn. That leaves $1,300 a month for the car itself. So if I can find a car that I have to pay monthly less than $1,300, it may just be a good deal.

So if I take 3 years car loan at 3% interest I probably should buy a car less than $43,000

if I take 5 years car loan instead, I could spend up to $67,826 for a car.

Consider the resell value as a bonus or final fund consolidation just in case maintainence shoots up or you ended up not using that car that much after all.

Labels:

Finance Planning

Monday, November 9, 2009

Nothing to see here...move along

We have Electronic Arts cutting 1500 jobs including a bunch here. We have Morgan Chase closing their Surrey call centre with the loss of 700 jobs, which followed close on the Ebay call centre closing last May which also saw 700 job losses... and here's what Kodak is doing http://tinyurl.com/yajcdhc

and yet RE is still strong!

That 1.5% Variable rate sure covers up a lot of outrageous pricing.

Who would have thought a couple of years ago, when we had our peak prices, that the US would be facing 10.2% unemployment and a real estate collapse, that BC's biggest resource..natural gas would be at multi-year lows, that BC and the Federal Government would be facing huge budget deficits and YET that our RE would be within spitting distance of those highs and in some other Canadian cities they would be at new highs??

Therein lies the power of devaluing money. Print it, pay nothing on it, lend it, spend it when you don't have it...ANYTHING to keep the worldwide bubble alive and well.

Maybe we are getting some $$ from HK. I just saw a BNN program on the price of RE in HK. If you think we are pricey here, you ain't seen nothing.

Meanwhile those pricey Olympic rentals aren't being absorbed. From the CBC:

Olympic rental market swamped with homes

Thousands of homeowners vying for Games tourists

Last Updated: Tuesday, November 3, 2009 3:49 PM PT Comments88Recommend33CBC News

Tanya Peters and Tyler Jones . (CBC)

The Olympic dream for many in B.C.'s Lower Mainland has little to do with sporting events or who makes it to the podium. They're hoping to rake in the gold by renting out their homes to tourists coming to the 2010 Games.

But it's not working out that way for everyone trying to take advantage of the opportunity. It appears the Olympic rental market has slowed to a crawl.

"There was that big buzz about people renting out their homes and making a killing on it," said Vancouver resident Tanya Peters.

Peters and Tyler Jones planned to get married in Costa Rica during the Games. Their vision was to rent out their house to Olympic visitors to help pay for the wedding. But so far, they have no takers, and now regret not hopping on the gravy train earlier.

"I know several people who rented out and did make a lot of money but they rented out a year ago," Peters said.

Corporations, teams and media outlets that needed to book homes in advance for big prices appear to have already made their bookings.

Jones and Peters have had their home listed on various websites since July. They have dropped their price to $3,000 for two weeks from $5,000.

A Vancouver couple hope to rent out this house during the Olympics, but find themselves in a market swamped with rentals. (CBC)

The explanation might be in the simple economics of the situation: There are more people who want to make big money than there are who want to spend it.

Thousands of homes for rent

"When the supply is larger than the demand, it's hard to maintain those price levels," said Bruce Fougner, president of Lloyds Travel Group in Vancouver.

Fougner estimated there were at least 6,000 homeowners in and around Metro Vancouver looking for Olympic renters right now. The majority of new rental listings were people wanting to get away, he said.

Jones and Peters say they are not giving up on their Olympic dream. And they plan to be on the beach in Costa Rica in February, no matter what.

But if they have to lower their price much further, it wouldn't cover the costs of additional insurance, fitting their home with extra beds and putting their valuables in storage, they said.

"We're not banking on it happening. But if it happens, that would be great," Peters said.

and yet RE is still strong!

That 1.5% Variable rate sure covers up a lot of outrageous pricing.

Who would have thought a couple of years ago, when we had our peak prices, that the US would be facing 10.2% unemployment and a real estate collapse, that BC's biggest resource..natural gas would be at multi-year lows, that BC and the Federal Government would be facing huge budget deficits and YET that our RE would be within spitting distance of those highs and in some other Canadian cities they would be at new highs??

Therein lies the power of devaluing money. Print it, pay nothing on it, lend it, spend it when you don't have it...ANYTHING to keep the worldwide bubble alive and well.

Maybe we are getting some $$ from HK. I just saw a BNN program on the price of RE in HK. If you think we are pricey here, you ain't seen nothing.

Meanwhile those pricey Olympic rentals aren't being absorbed. From the CBC:

Olympic rental market swamped with homes

Thousands of homeowners vying for Games tourists

Last Updated: Tuesday, November 3, 2009 3:49 PM PT Comments88Recommend33CBC News

Tanya Peters and Tyler Jones . (CBC)

The Olympic dream for many in B.C.'s Lower Mainland has little to do with sporting events or who makes it to the podium. They're hoping to rake in the gold by renting out their homes to tourists coming to the 2010 Games.

But it's not working out that way for everyone trying to take advantage of the opportunity. It appears the Olympic rental market has slowed to a crawl.

"There was that big buzz about people renting out their homes and making a killing on it," said Vancouver resident Tanya Peters.

Peters and Tyler Jones planned to get married in Costa Rica during the Games. Their vision was to rent out their house to Olympic visitors to help pay for the wedding. But so far, they have no takers, and now regret not hopping on the gravy train earlier.

"I know several people who rented out and did make a lot of money but they rented out a year ago," Peters said.

Corporations, teams and media outlets that needed to book homes in advance for big prices appear to have already made their bookings.

Jones and Peters have had their home listed on various websites since July. They have dropped their price to $3,000 for two weeks from $5,000.

A Vancouver couple hope to rent out this house during the Olympics, but find themselves in a market swamped with rentals. (CBC)

The explanation might be in the simple economics of the situation: There are more people who want to make big money than there are who want to spend it.

Thousands of homes for rent

"When the supply is larger than the demand, it's hard to maintain those price levels," said Bruce Fougner, president of Lloyds Travel Group in Vancouver.

Fougner estimated there were at least 6,000 homeowners in and around Metro Vancouver looking for Olympic renters right now. The majority of new rental listings were people wanting to get away, he said.

Jones and Peters say they are not giving up on their Olympic dream. And they plan to be on the beach in Costa Rica in February, no matter what.

But if they have to lower their price much further, it wouldn't cover the costs of additional insurance, fitting their home with extra beds and putting their valuables in storage, they said.

"We're not banking on it happening. But if it happens, that would be great," Peters said.

Thursday, November 5, 2009

Bus Fares = OK but ...

50% Zone 1 RM 1.1030% Zone 2 RM 1.9010% Zone 3 RM 2.5010% Zone 4 RM 3.10

Typically one may need to take 2 bus routes to reach destination. So one trip is RM 3.40 or Return trips are RM 6.80

1 week or 5 working days would mean a cost of RM 34 or RM 136 a month or RM 1,632 a year.

Travel within Kuala Lumpur using private transport is average at half an hour. Relatively using buses for the same destinations would increase the travel time to 1.5 hours; include waiting and walking time.

There you go, if you use buses as your main transport, you may need more than RM 1,500 a year and 720 hours commute time. You may save some money yearly but in the cost of 480 hours.

Do you bus ?

New Bus Fares in West Malaysia effective 1 August 2009KL Buses :Zone1 RM 1 to RM 1.10Zone2 RM 1.70 to RM 1.90Zone3 RM 2.20 to RM 2.50Zone4 RM 2.70 to RM 3.10Other Buses :(No Air Con) RM 0.62 first 2 km, RM 0.094 every km thereafter(Air Con) RM 0.94 first 2 km, RM 0.094 every km thereafterMini Buses :(No Air Con) RM 0.90 one way(Air Con) RM 1 one waySchool Buses:(Town) Monthly RM 27.43 first km, RM 2.02 every km thereafter.(Rural) Monthly RM 20.61 first km, RM 2.02 every km thereafter.Express Buses : RM 0.085 / km

Labels:

Finance Planning

Wednesday, November 4, 2009

....getting us pumped up for the Olympics

It seems like we are not getting sufficiently excited about having an extremely expensive sports event and hundreds of thousands of people descend on our densely populated over-crowded strip of SE BC.

So we now have media ads featuring our Canadian athletes extolling us to support them, we have a news radio channel (official radio station of the Olympics) telling us how many great jobs are opening up in serving and bar tending. We also have the workers at Whistler being taught by some person from Disney University (yes it exists) and how to be a gracious host. Even Gregor Robertson was all excited about the Olympic Village today and one athlete was telling the media how great it was to be able to stay in luxury accommodation. Bob Rennie was reassuring them that the city wont be on the hook for the 1100 units. lets hope he is right.

Enough already!

There are some of us curmudgeons who really didn't want these games. We cant get around the city as it is. We think affordable housing is a better use of money than big ice rinks and Multimillion dollar ski runs. We don't want Hundreds of Millions spent on security. As for the athletes, we wish them well, very well, but the cost of hosting it here could have been better spent on them..help them train, buy them equipment AND have the whole event somewhere else.

Anyway we are stuck with it and all the inconveniences and it will bring. But please VANOC and major sponsors, spare us the..'we-are-doing-it-for-athlete's' BS. The developers and speculators have done VERY well out of this event. The politicians will feel important for a couple of weeks, and the Olympics have just become a contest of tallying who has the most medals which seems to me to defeat the purpose which is...what is it again?

So we now have media ads featuring our Canadian athletes extolling us to support them, we have a news radio channel (official radio station of the Olympics) telling us how many great jobs are opening up in serving and bar tending. We also have the workers at Whistler being taught by some person from Disney University (yes it exists) and how to be a gracious host. Even Gregor Robertson was all excited about the Olympic Village today and one athlete was telling the media how great it was to be able to stay in luxury accommodation. Bob Rennie was reassuring them that the city wont be on the hook for the 1100 units. lets hope he is right.

Enough already!

There are some of us curmudgeons who really didn't want these games. We cant get around the city as it is. We think affordable housing is a better use of money than big ice rinks and Multimillion dollar ski runs. We don't want Hundreds of Millions spent on security. As for the athletes, we wish them well, very well, but the cost of hosting it here could have been better spent on them..help them train, buy them equipment AND have the whole event somewhere else.

Anyway we are stuck with it and all the inconveniences and it will bring. But please VANOC and major sponsors, spare us the..'we-are-doing-it-for-athlete's' BS. The developers and speculators have done VERY well out of this event. The politicians will feel important for a couple of weeks, and the Olympics have just become a contest of tallying who has the most medals which seems to me to defeat the purpose which is...what is it again?

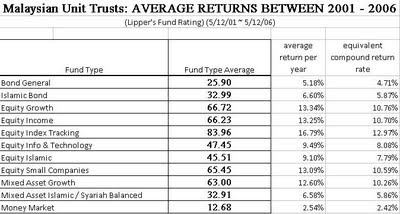

Malaysia Unit Trusts 5 years Return

Below table shows the return of Unit Trusts in Malaysia from 2001 to 2006. I added two columns to the right.

Average return per year is simply return divided by number of years, in this case, n / 5 years ie. 25.9 / 5 = 5.18

Equivalent Compound Return Rate is using the FV formula to calculate what the interest rate would be if you save $100 5 years ago to get the same return. This is the number you should use to compare with Fix Deposit interest rate.

Pit falls ? Not so much on that but some key concepts when reading numbers like this ...

These numbers don't mean much by themselves. You should compare them with other numbers to make more senses and decide course of action. For example;

- Compare with Stock Market indexes. Mutual funds are suppose to outperform certain benchmarks. So a fund is only really doing well when it is BETTER than ....

- Compare with Fix Deposit interest. Are these rates significantly higher than FD through the same period ?

- Compare with Inflation rates. Similar to FD comparison but from a different angle.

- Compare with itself. How are the performances 2002-2007, 2003-2008 etc ? 2007 to 2008 are losing years. If one uses 2001-2006 as the 'BEST' years, then numbers of 2007 to 2008 should also be analysed as the 'WORST' years - as in comparing reward and risk ratio.

Lastly, match past record to today's situation. Index Tracking funds did the best during economy recovering years from 2001-2006. Is today's economy like 2001 ? If yes we should buy ! Or is today more like 2006 where economy is booming but due to doom ? If yes we should probably cash out. Or is today in between ?

Don't know what this is all about ? Apply Dollar Cost Averaging.

Remember that if you apply DCA, above mentioned returns do not apply to you neither.

Labels:

Mutual Fund

EPF Interest Calculation - Pro Rated

EPF's interest calculation is one of the weird ones. Somehow they don't use the straight forward FV formula. Although it may seems like they are stupid and don't know math but the actual reasons are;

1) They don't really know how much to pay you until after financial closing at year end

2) your employer may submit your contribution to EPF LATE

3) legacy system left over from British colony time

In short, EPF interest calculation is pro rated. So

1) Whatever you have left last year will enjoy full interest payment this year.

ie. $100,000 x 4% = $4,000

2) Amount you save on 1st month will enjoy 11 month interest, 2nd month will enjoy 10 months interest etc.

ie. in January $100 x 4% x 11 / 12

ie. in February $100 x 4% x 10 / 12

The exact words from KWSP

| » | How is the EPF dividend calculated? |

In order to determine the dividend rate, factors that need to be taken into consideration include net income and total for 1% dividend at year-end.

For example:

Dividend Rate = Net income (a) x 1% Total for a 1% dividend (b)

For example:

Dividend Rate = Net income (a) x 1% Total for a 1% dividend (b)

- Investment income + Non-investment income - Expenses

- Total for a 1% dividend is based on:

- Opening balance of contribution (after withdrawal) that obtain dividend for a 12-month period, and

- Monthly contribution that obtain pro rated dividend i.e. dividend for the n-month will get (12-n) month dividend. For example, the September contribution (n=9) will obtain a 3 months dividend.

Under Section 27 of the EPF Act 1991, the guaranteed minimum dividend rate is 2.5% per

year on members' savings.

Example Calculation based on this article : MYR300 FREE Money

This document can be found here

There are many EPF calculation tools online. Unfortunately, none of them will show the same figures. So above calculation is actually different than what some of the banks web site will tell you. Even the EPF web site itself will show different figures than the banks and this article. However, this calculation method posted here, has been shown to KWSP HQ 2 years ago and the officers confirm correctness.

So treat this as one of the ways to calculate EPF interest, not the absolute correct and only way. I have seen 2 person EPF return calculated differently. After reporting to KWSP, they simply pick the lower payout methods without much justification. Since then, we do not report inconsistency in their calculation anymore unless it is LESS than what we should get.

Labels:

case study,

Money

Tuesday, November 3, 2009

Its NOT just a finance game ... unfortunately

A short while ago, I wrote that charging MYR50 to credit card users is an ineffective way to reduce credit card debt. I even predicted that government would soon realize this mistake and relax in execution later on. Quite a few large finance institutions thinks the same too. But of course they have their own agenda.

But I was wrong. Life is never monotonous. Personal Finance is NOT just about personal and finance. If you live on a land that has a country name, there are politics. And Politics matter, especially in this case.

This is my Right !

I can DO THIS and

I AM DOING IT !!

Perhaps we push too fast, too strong and making our finance ministry looks like a fool. Hence, our TOP decision maker has now publicly declared that HE is going to charge the MYR 50 NO MATTER WHAT !

Rumors or insider news, bankers are warn NOT to absorb the MYR 50 or else they will face indirect penalty withdrawing other facilities have been given to them. HE is very determined to collect this MYR 556 millions !!

You have a Problem ?

You Come Talk to me !

Ok, ok I will pay you MYR 50 ....

Labels:

case study,

joke,

Money

Monday, November 2, 2009

Malaysia Taxi Fares = developed nation

The fee is MYR 3 for the first kilometer and then MYR 1.74 for every kilometer there after.

As many may have known, public transport in Malaysia is not exactly efficient. One of the problems is the location of varies train stations. Generally and averagely speaking, a person may need to travel 2-4 kilometers before reaching a station. That would be half an hour to one hour walking time. If one doesn't have that time or the stamina, she will have to take a taxi. That would be MYR 6.50 for one person one way excluding reservation or call surcharge. Return would be MYR 13. MYR 65 / week, MYR 260 a month and more than MYR 3,000 a year.

What is your distance to the nearest public transport station other than bus station ?

note: above calculation is based on my own experience where I paid RM 3 for the first 1km and then RM 0.20 for every 115 meter onwards. However, the new published rates are;

Klang Valley, KL, Johor Bahru, Melaka, KTRM 3 ( first km or first 3 mins ) andRM 0.10 every ( 115 meter or 21 seconds ) onwardsPenangRM 4 ( first km or first 3 mins ) andRM 0.10 every ( 115 meter or 21 seconds ) onwards

I am not sure if I was caught in between transition and being charged RM 0.20 or was I financially abused by the taxi driver specifically ...

Sunday, November 1, 2009

October Numbers

As usual Larry Yatter is the first one out with the numbers for average prices:

http://www.yattermatters.com/real-estate/vancouver-average-price-october/#more-7284

They show that detached are within a hair of the highs and apartments and attached look to have surpassed their previous highs.

Well what can we say about the graph...as I said every 'bubble bursting graph' will look different. I gave some examples in this post:

http://fishyre.blogspot.com/2009_09_01_archive.html

It may be that we are following the more complex top set by places like Southern California :

http://www.doctorhousingbubble.com/wp-content/uploads/2009/01/socal-housing-prices.png

However I have to say, if we continue with these strong gains, then we may have to admit that a new up-trend has started...difficult though that is to believe...from these lofty levels, driven by all-time low interest rates.

I expect all Canadian cities to show gains.

Here is how it happened:

We are in the same position as places like Norway and Singapore. Norway is resource-rich, and Singapore is fiscally sound. We are probably both. When the crisis happened, interest rates world-wide crashed and many areas outside of the US and UK where banks had been completely irresponsible did not need this extra stimulus. The result was a new property boom.

The rates dropped to save banks and to help manufacturing, but what they did was reignite assets. Look at gold well over $1000 and property prices in many parts of the world started to take flight.

Some of these areas were Norway, Hong Kong, Singapore and South Korea and of course Canada.

Of course in the other jurisdictions they are doing something about it. In Norway they are raising interest rates specifically to cool RE. Regulators in South Korea, Hong Kong and Singapore told banks they needed to tighten lending, to nip the RE bubble in the bud.

Meanwhile what are we doing? We have a few words of caution from Mark Carney but no increase in interest rates, and the Government with one eye on the next election, is INCREASING the ability of the CHMC to lend at these over-priced levels.

We are truly setting ourselves up for a crisis. Both by feeding the fire of price speculation, and encouraging folks to get into the market with very little skin in the game AND at the lowest rates in history.

We should be doing the opposite. Waiting until rates are high and likely to go down, wait until prices have fallen and then help people buy..they would be getting in at the bottom of the prices an the top for rates not vice verse.

We are just setting these folks up for failure at the slightest rise in rates, drop in value or increase in job losses.

Enough said. Lets see what November brings. The October numbers were not heartening for those waiting for more reasonable prices.

http://www.yattermatters.com/real-estate/vancouver-average-price-october/#more-7284

They show that detached are within a hair of the highs and apartments and attached look to have surpassed their previous highs.

Well what can we say about the graph...as I said every 'bubble bursting graph' will look different. I gave some examples in this post:

http://fishyre.blogspot.com/2009_09_01_archive.html

It may be that we are following the more complex top set by places like Southern California :

http://www.doctorhousingbubble.com/wp-content/uploads/2009/01/socal-housing-prices.png

However I have to say, if we continue with these strong gains, then we may have to admit that a new up-trend has started...difficult though that is to believe...from these lofty levels, driven by all-time low interest rates.

I expect all Canadian cities to show gains.

Here is how it happened:

We are in the same position as places like Norway and Singapore. Norway is resource-rich, and Singapore is fiscally sound. We are probably both. When the crisis happened, interest rates world-wide crashed and many areas outside of the US and UK where banks had been completely irresponsible did not need this extra stimulus. The result was a new property boom.

The rates dropped to save banks and to help manufacturing, but what they did was reignite assets. Look at gold well over $1000 and property prices in many parts of the world started to take flight.

Some of these areas were Norway, Hong Kong, Singapore and South Korea and of course Canada.

Of course in the other jurisdictions they are doing something about it. In Norway they are raising interest rates specifically to cool RE. Regulators in South Korea, Hong Kong and Singapore told banks they needed to tighten lending, to nip the RE bubble in the bud.

Meanwhile what are we doing? We have a few words of caution from Mark Carney but no increase in interest rates, and the Government with one eye on the next election, is INCREASING the ability of the CHMC to lend at these over-priced levels.

We are truly setting ourselves up for a crisis. Both by feeding the fire of price speculation, and encouraging folks to get into the market with very little skin in the game AND at the lowest rates in history.

We should be doing the opposite. Waiting until rates are high and likely to go down, wait until prices have fallen and then help people buy..they would be getting in at the bottom of the prices an the top for rates not vice verse.

We are just setting these folks up for failure at the slightest rise in rates, drop in value or increase in job losses.

Enough said. Lets see what November brings. The October numbers were not heartening for those waiting for more reasonable prices.

Subscribe to:

Comments (Atom)