Monday, October 31, 2011

Happy Halloween!

Friday, October 28, 2011

Out of Town for a Few days

Tuesday, October 25, 2011

Get ALL Your Tax back . . .

Lets say this year your gross income is $20,000 ( about $ 1,700 a month ), you may start to pay tax. ( about $10 a month ).

Click the extend + sign to see everything. Then think of which item is relevant to you. For below case, this guy can

- buy a life insurance of $ 3,800

- buy $500 magazines

- buy a $2,000 PC

The web site is just an estimator or for fun or for educational purpose only. Your actual tax plan and figures may subject to your very own unique condition. Do consult a proper tax consultant or IRB is providing FREE advices when it is near tax submission date.

Enjoy !!

Saturday, October 22, 2011

MOI quickie

Friday, October 21, 2011

Sorry guys too busy to post the MOIs

Tuesday, October 18, 2011

Afternoon Snack

Robert Kiyosaki copied our article ?

just kidding, of course.

Monday, October 17, 2011

Sunday, October 16, 2011

Where are we

We are certainly in a flat market at best in most parts of Vancouver and the Fraser valley. Many areas are well into 7-8 MOI and by definition into a buyer's market. However how soon price drops follow depends on many things that we need to keep an eye on:

1) China is primary amongst these. Not only are the Chinese the big money buyers in many areas (yes they are) but our dependence on resources also makes their financial situation doubly important for our housing market. They stumble and we fall.

2) Interest rates. Super low. No sign yet of any of the irresponsible Central banks that got us into this mess allowing long or short rates up. In fact the US Central bank is even buying it's own long bonds to keep rates low. BTW- They started talking about doing this late September. Do you think they may have Wall Street insiders know a little sooner??

No wonder people are marching in the streets, the current system reeks of corruption.

Anyway back to rates- no increase on the horizon. On the contrary if Europe falters, then US and Canadian bonds will be seen as a safe-haven and rise. Only if things get REALLY bad and banks can't borrow and therefore can't lend will we see pressure on mortgages. I would not bank on this happening ;)

3) Government policy. After a series of catastrophic policy decisions (IMVHO) helped pump up RE, turning the virtuous Canadian economy into a borrow and spend US-wannabe, I cannot forecast what these bozos will do next. The C-team in Ottawa seems to have remembered their fiscal Conservatism a little now, but I would not put it past them to give way if housing drops and reach for the CMHC-pedal again. Pumping up the CMHC is the way Government increases debt and liabilities for us all, without it showing up on the country's balance sheet. Meanwhile they can pretend to be holding the line on the deficit (which is already 'structural' according to the Auditor General).

4) The US. We are still very dependant on the US - for 70% of our exports in fact. So any re-recession will also hit us and you can expect Carney to remove the 1% he gave to savers. More money will have to be transferred from the prudent savers to the reckless speculators.

5) Watch the stock-market. Lo and behold the market went up and we got a bounce in Vancouver sales the last few days. It is an odd correlation. I suspect it is multi-factorial..there is a feel-good, we are all wealthy attitude, there is the insiders who cash out stock options, and of course there are the Chinese who sell hundreds of Millions of stock and diversify to whatever and where-ever they can.

Can I forecast all of these. Nope. Not even one of them. And they will move in opposite directions. If Europe starts defaulting, expect a number of things- long interest rates here to drop, short interest rates to be cut, the USD to rally, commodities to drop, China to drop, and our market to drop!

So what will be the net effect? ...ummm

Anyway we will be watching the inventory numbers and I will have some MOI up mid-week for you all to look at -including the Fraser Valley. Glad to be rid of Adsense. I am sure it works for some, but it sure didn't work for me!

Friday, October 14, 2011

First Item for Craft Fair Completed

Wednesday, October 12, 2011

Tuesday, October 11, 2011

Happenings....with very little motivation!!

Monday, October 10, 2011

Some Court ordered Sales

Friday, October 7, 2011

A new level of Frugality

Its Cycling To Work !

Mathew was a guy who suffers from a terrible 24.3% inflation in 2009. After he started to follow this blog, he has learned a trick or two to keep things going smoother. Today he is working as a top executive in a public company but situation hasn't changed much. He is still in middle level income group. After his 5 figures income divided by the number of people he has to support, his actual cash-at-hand per person monthly is much less than average personal income ie. $1,500.

Many staffs who worked for Mathew always complains about how tough their lives are and demand a salary increment without extra performance to the company ( while their single income is about $1,500 as well). Mathew thinks it was obvious his staffs weren't educated well enough in personal finance so he decided to role model to show a point - live frugally.

He used to drive about an hour to work, commute about 22 km and then spent about $10+ for parking fee. Now instead of doing all that, now

After the decision was made, he first bought a huge term insurance to cover this temporary needs. After all, he doesn't want his teaching to his staff to affect his even more important loves to his families.

Once the insurance is approved, he started cycling to work. It wasn't easy. He first followed his driving route. It was dangerous as cars and motorbikes are cruising fast by, ignoring his existence. But the good thing about cycling . . . is that its both a pedestrian and a driver. So very soon he found a much shorter and safer path, only 12.1km instead of driving 22 km away.

It took him about one hour to cycle to work. ( Above 2.5 hours was for walking time ) So practically this doesn't affect any of his schedule at all. As a matter of fact, this improve the stability of his schedule. Even when there is an unexpected traffic jam which would cause a normal 1 hour driving to 2-3 hours, his cycling time remains the same as 1 hour.

Mathew also lost 6-8kgs since then, has a much tougher built body now. He used to pay a lot joining fitness centers etc. but never got the time to actually exercise because he is a workaholic. Now he HAS TO exercise 2 hours a day.

Mathew also started a health diet to eat more veggie and fruits even before this cycling idea. Thanks to this cycling exercise, his cycling route passed by a local market at Chow Kit ( one of the oldest and largest wet market in Kuala Lumpur ), he now manages to buy 5 star fruits for only $1, which fuel his breakfast and lunch.

There are much more indirect benefits he received since he started cycling to work. But as everything goes, there must be some Cons that comes with the Pros. Should one accident happens during his cycling commute, it would most probably cost him his life. While he was well aware of the risk, he took action to insure against that rick and he also find ways to improve his own skills and awareness to maximize his own safety.

There are quite a lot of tips and tricks he has developed since he cycles to work. If you were moved by this article and wanted to try this too . . . be warn ahead, there is some risks involved. Do spend some time to buy me a cup of coffee so I can share with you whatever those tips and tricks are so that you can minimize your risk and maximize your return / saving / investment.

| Driving | Cycling | |

| Time | 1 hour | 1 hour |

| Petrol | $10 per day | $0 |

| Parking | $5 - $10 per day | $0 |

I am just glad living frugally in a city like Kuala Lumpur has just gone one level deeper. With tons of other extra benefits and with only ONE major risk that a person who really cares can mitigate easily with skills and experience.

Have you managed to find any innovative ways to cut your expenditure or increase your saving by 25% !?

Thursday, October 6, 2011

Sew Much Fun

Time to stick that neck out even further...

Nothing ventured, nothing gained.

Nothing ventured, nothing gained.Wednesday, October 5, 2011

Quick OK RAW DATA...

Not sure how reliable the average and median prices are. I have tended to ignore them in the past since they show such huge fluctuations month to month due to the small sample size. Sales and MOI are the most important indicators IMO.

Central OKANAGAN. Where the action is! Sales up from last year. Prices mixed compared with August and flat YOY. see for yourselves. Higher averages, lower median suggesting the upper end buyers are still active. MOI = 14.

September 2011

Condo/Apt

Sales 65 New Listings 180 Current Inventory 878 Sell/Inv. Ratio 7.40% Days to Sell 107 Average Price $256,189 Median Price $212,500

Condo/Townhouse

Sales 40 New Listings 96 Current Inventory 540 Sell/Inv. Ratio 7.41% Days to Sell 127 Average Price $328,331 Median Price $303,646

Lots

Sales 11 New Listings 44 Current Inventory 643 Sell/Inv. Ratio 1.71% Days to Sell 226 Average Price $185,036 Median Price $175,000

Residential

Sales 145 New Listings 362 Current Inventory 1,590 Sell/Inv. Ratio 9.12% Days to Sell 88 Average Price $517,864 Median Price $427,000

Ratio of Sales vs Inventory 7.15%

August 2011

ResidentialCondo/Apt

Sales 63 New Listings 151 Current Inventory 934 Sell/Inv. Ratio 6.75% Days to Sell 117 Average Price $243,307 Median Price $237,000

Condo/Townhouse

Sales 39 New Listings 98 Current Inventory 546 Sell/Inv. Ratio 7.14% Days to Sell 118 Average Price $355,573 Median Price $350,000

Lots

Sales 17 New Listings 50 Current Inventory 117 Sell/Inv. Ratio 14.53% Days to Sell 167 Average Price $241,294 Median Price $189,900

Residential

Sales 132 New Listings 357 Current Inventory 1,709 Sell/Inv. Ratio 7.72% Days to Sell 85 Average Price $470,138 Median Price $431,935

Ratio of Sales vs Inventory 7.59%

September 2011

Condo/Apt

Sales 37 New Listings 158 Current Inventory 988 Sell/Inv. Ratio 3.74% Days to Sell 105 Average Price $234,800 Median Price $218,000

Condo/Townhouse

Sales 33 New Listings 87 Current Inventory 493 Sell/Inv. Ratio 6.69% Days to Sell 109 Average Price $341,088 Median Price $332,000

Lots

Sales 5 New Listings 71 Current Inventory 613 Sell/Inv. Ratio 0.82% Days to Sell 92 Average Price $217,180 Median Price $195,000

Residential

Sales 117 New Listings 392 Current Inventory 1,666 Sell/Inv. Ratio 7.02% Days to Sell 92 Average Price $466,382 Median Price $425,000

Ratio of Sales vs Inventory 5.11%

NORTH OK

Sales down. Prices mixed YOY. MOI = 21

September 2011

Sales 10 New Listings 16 Current Inventory 158 Sell/Inv. Ratio 6.33% Days to Sell 277 Average Price $155,250 Median Price $148,000

Condo/Townhouse

Sales 10 New Listings 40 Current Inventory 250 Sell/Inv. Ratio 4.00% Days to Sell 143 Average Price $232,640 Median Price $246,250

Lots

Sales 8 New Listings 44 Current Inventory 327 Sell/Inv. Ratio 2.45% Days to Sell 118 Average Price $171,613 Median Price $170,000

Residential

Sales 46 New Listings 134 Current Inventory 816 Sell/Inv. Ratio 5.64% Days to Sell 119 Average Price $401,684 Median Price $363,500

Ratio of Sales vs Inventory 4.77%

September 2010

Sales 9 New Listings 22 Current Inventory 187 Sell/Inv. Ratio 4.81% Days to Sell 138 Average Price $157,322 Median Price $164,500

Condo/Townhouse

Sales 15 New Listings 39 Current Inventory 227 Sell/Inv. Ratio 6.61% Days to Sell 119 Average Price $302,467 Median Price $295,000

Lots

Sales 11 New Listings 33 Current Inventory 394 Sell/Inv. Ratio 2.79% Days to Sell 161 Average Price $151,800 Median Price $155,000

Residential

Sales 69 New Listings 135 Current Inventory 743 Sell/Inv. Ratio 9.29% Days to Sell 110 Average Price $385,819 Median Price $348,000

Ratio of Sales vs Inventory 6.71%

Shuswap/ Revelstoke- sales up a bit prices mostly down YOY. MOI = 20

September 2011

Condo/Apt

Sales 3 New Listings 3 Current Inventory 66 Sell/Inv. Ratio 4.55% Days to Sell 155 Average Price $233,000 Median Price $173,000

Condo/Townhouse

Sales 9 New Listings 9 Current Inventory 96 Sell/Inv. Ratio 9.38% Days to Sell 158 Average Price $314,011 Median Price $333,000

Lots

Sales 10 New Listings 15 Current Inventory 301 Sell/Inv. Ratio 3.32% Days to Sell 311 Average Price $199,690 Median Price $75,000

Residential

Sales 24 New Listings 69 Current Inventory 446 Sell/Inv. Ratio 5.38% Days to Sell 113 Average Price $315,003 Median Price $297,500

Ratio of Sales vs Inventory 5.06%

September 2010

Condo/Apt

Sales 2 New Listings 9 Current Inventory 61 Sell/Inv. Ratio 3.28% Days to Sell 59 Average Price $184,000 Median Price $184,000

Condo/Townhouse

Sales 2 New Listings 3 Current Inventory 100 Sell/Inv. Ratio 2.00% Days to Sell 112 Average Price $350,625 Median Price $350,625

Lots

Sales 8 New Listings 29 Current Inventory 28 Sell/Inv. Ratio 28.57% Days to Sell 65 Average Price $596,375 Median Price $140,000

Residential

Sales 19 New Listings 55 Current Inventory 407 Sell/Inv. Ratio 4.67% Days to Sell 126 Average Price $330,868 Median Price $337,000

Ratio of Sales vs Inventory 5.20%

Tuesday, October 4, 2011

REBGV Numbers out (and more)

Here it is.

"Those sales also rank as the third lowest total for September over the last 10 years."

"Consistent increases in property listings and fewer home sales over the summer months has helped move the Greater Vancouver housing market into the upper end of a buyers’ market."

"“Our sales-to-active-listing ratio currently sits at 14 per cent, which is the lowest it’s been this year. Generally analysts say that a buyer’s market takes shape when the ratio dips to about 12 to 14%, or lower, for a sustained period of time,” Setticasi said."

Benchmark Attached and Aprtments 4-5% above last year. Detached still 13% over last year.

MOI= 7.2

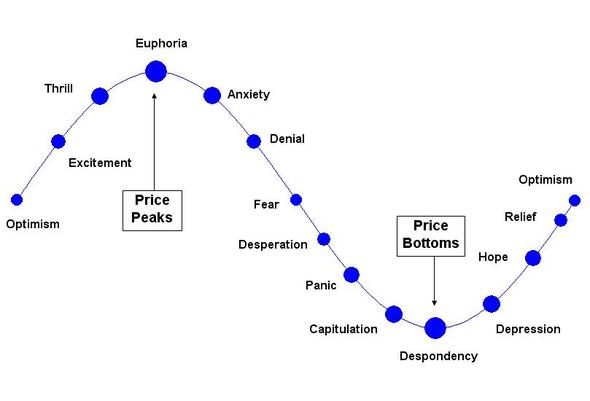

My take. We peaked in May 2011. We are in a different environment now. More later.

BTW - Jesse has just put up some outstanding graphs on the state on the housing market. Look at the MOI graph in particular. We were heading down in 2010. we are heading UP now.

PS - Here is Fraser Valley

“This is the third month in a row based on the 10‐year average where

we’ve seen lower sales combined with a higher influx of new listings.”

Benchmark up from last year. SFH + 4.5% Attached + 1.8% Apartment + 1.6%

It wont take much to send those numbers down into negative YOY.

The average price for SFH and Attached are already -ve YOY by 0.8% and 1.5%

The Median price for apartments are -ve YOY by 1.1%.

MOI = 8.7...growl..

So depending on what you want to follow- Average, median or benchmark..the stats show the three categories to be up or down marginally year on year. ie Flat.

The next month's stats will establish the trend.

Monday, October 3, 2011

Interview : FatherSez - fathersez.com

Although we never met and now lost the chance to ever meet again, we never feel far apart. During earlier years even after 100 posts, I was still a skeptic about blogging. It was actually FatherSez who found my sharing useful and kept me going.

Even years after his departure, I never forget every single word we transact online; through our virtual identities. But he was busy with his venture and I was busy with my entrepreneurship back then as well. We never met in person although both of us wanted to. Well, at least I wanted to ( Fathersez received too many requests to meet that he couldn't accommodate to all . . . )

FatherSez is unique in his own way because it was clearly a message from parent to kids. It was written with a legacy in mind, for the kids and the future. I haven't read a personal finance blog that is as parental, as philosophical, as practical and most truthfully show his love toward his kids without reservation.

I was very scare and afraid after confirming the fact that he did pass away 7 months after his departure. I worry his web site will be shut down very soon. But 2 years down the road, I managed to contact one of his legacy, Azah. And words cannot describe how grateful I am when I know FatherSez is still alive today. This simply means whatever message FatherSez wanted to deliver has been well received.

I have conducted email interviews to some of the personal finance web sites or blogs recently. Fathersez is one of them. Since I couldn't reach Fathersez anymore, I made a request to his legacy. To my surprise, she accepted the interview request ...

At young age, Fathersze was one of those where today's basic necessity was not readily given by nature. He had to walk 12km to school. Luckily his uncle had supported him mostly not from any monetary form but most critically important - the existence of love and family tie. Also thanks to his uncle? Fathersez was exposed to accounting at early age, as early as his primary school time working in a cloth selling shop. This was one of the key differentiation why he was able to contribute so much to our personal finance blogsphere today. For other luckier kid like me, I was only worrying what lunch I can have with my 50 cents pocket money for that day.

. . . here is the original interview scripts . . . with minor censorship for privacy reason.

If you were also a FatherSez follower before you read this, you would most probably agree with me that a FatherSez 2.0 is in the making. The way Azah write and feel for herself and also on behalf of Fathersez, clearly show how great a legacy FatherSez had left behind. And how similar she is to her father. And yet with a touch of 21st century of her own.

Lastly, a word for my dear friend Fathersez, for science or for faith, I hope one day you can read this . . . one way or another, I want you to know without a single doubt, a stranger like me . . . miss you very much too.

Saturday, October 1, 2011

A few things to ponder while we wait for the official numbers and the FVREB stats

Wandering around the internet I found some good reads.

Leading real estate professionals reacted today to yesterday's news that home prices in Vancouver now exceed New York and London's. One realtor said he believes that buyers from Mainland China have pushed the local buyers out of the market. Each cited homes bought and traded like stocks and bonds and investment properties sitting empty, but some see the Chinese home rush as a bonus to Vancouver, while another sees it as a liability.

"Many people who buy here aren't buying because they're moving here," said Hasman. "They're buying on speculation or to park money here ... There have been cases where people come and purchase five or six houses. No one needs five to six houses unless you're speculating.

And this blog illustrates an excellent example of the above.

How about we all send a link to the first article to our Political representatives. I like the line about 'No one needs five to six houses...etc'

Add your own commentary. Eg the the effect of this unfettered access to our RE market is having on you personally. How unfair it is that we are one of the few places that do not restrict speculators access to housing stock. How it puts pressure of those living here due to unaffordable prices AND empty houses -and will cause a crisis when the bubble finally pops.

Lets make this an issue! The real estate industry- developers, Realtors, mortgage industry and speculators are a very powerful lobby. Let's push back a little.