Anon said:

"In Nov 2008, we almost had a great depression. That is what it took to bring the prices down.

Now we are much higher. Anyone guess what it's going to take for an encore? Probably nothing, hence if prices do drop it will be 5-10% at MOST."

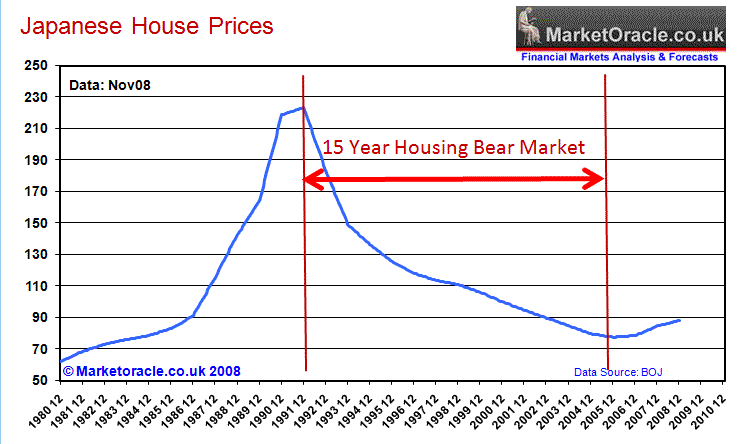

He/she has a point. The rebound has happened at lightening speed. Look at Japan for example. When their RE bubble started to burst in 1992, interest rates were cut aggressively, and stayed low. In fact the cutting started just before the bust got going.

However once it started there was nothing that could prevent the drop. However here and in the US, our governments have also cut interest rates to the same absurdly low levels and while it hasn't done much for US housing, our prices have reignited again.

"In Nov 2008, we almost had a great depression. That is what it took to bring the prices down.

Now we are much higher. Anyone guess what it's going to take for an encore? Probably nothing, hence if prices do drop it will be 5-10% at MOST."

He/she has a point. The rebound has happened at lightening speed. Look at Japan for example. When their RE bubble started to burst in 1992, interest rates were cut aggressively, and stayed low. In fact the cutting started just before the bust got going.

However once it started there was nothing that could prevent the drop. However here and in the US, our governments have also cut interest rates to the same absurdly low levels and while it hasn't done much for US housing, our prices have reignited again.

The two charts above show the price of Japanese RE and interest rates: