The latest were this and this.

This was the first detailed set of results the CMHC has published and showed declining activity thanks to Flaherty's changes. Here is a snippet:

According to the CMHC, these numbers show it’s doing a good job of maintaining a healthy, sustainable housing market.

But Finn Poschmann, vice president of research at the C.D. Howe Institute, is skeptical. “The size of the drop in refinancing is surprising to the point of shocking,” Mr. Poschmann said in an email. “You could hardly have better evidence of the extent to which CMHC practices have been supporting high debt and risky borrowing by homeowners.”

A frequent critic of the organization, Mr. Poschmann argues that CMHC practices have helped inflate housing prices and encourage consumers to take on more debt than they can handle.

It's obvious isn't it- if you help people buy more than they can afford you will be pumping an already over-heated RE market. Of course the CMHC has tried to defend it's actions. All organizations want to feel that they are doing good, and want to expand and grow not be kept in check.

I can see how in it's early days the CMHC may have had a role. Prices were low, interest rates were high and folks had trouble getting loans. They were there to insure the riskiest of loans.

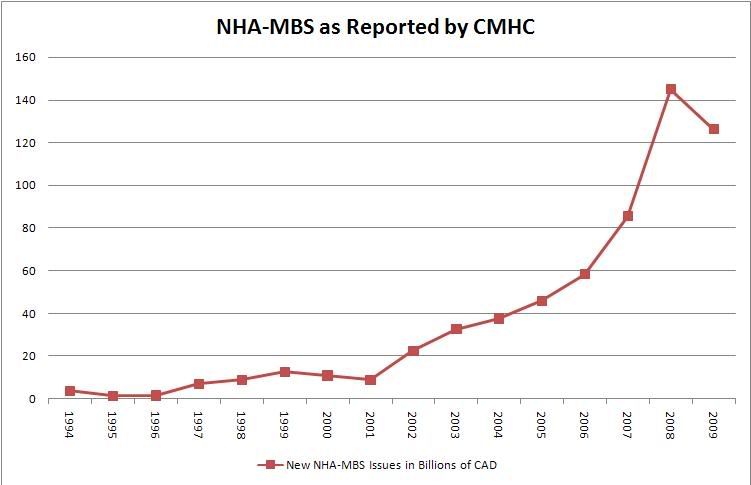

Yes it would have been better to leave it to private insurers, but we cannot fault it too much. RE was slowly rising and CMHC helped people get into positions to build equity. Most importantly it was small:

I won't dwell on the fact that CMHC ended up insuring rental and investment properties which is well beyond and goes aginst it's apparent mandate- to help Canadians own a home.

Now fast forward to today. We are sitting at very high RE values. we have easy lending standards with banks and mortgage brokers falling over themselves to lend and lastly we have the lowest interest rates in memory.

This would be the worst, most riskiest time to insure high-leverage mortgages. Not only that, but by adding further marginal buyers to this over-heated RE pile, they are making it even more difficult for the next generation of buyers to get into the market. Soon everyone needs CMHC insurance to get onto the first step.

A self-reinforcing loop.

Meanwhile the CMHC has bloated up since the above graph to a mega-monster! Over $500 Billion of coverage, $45 Billion of which have 10% or less equity and if we correct, as we surely, eventually, WILL- the Canadian tax payer will be on the hook and Government spending will be severely affected to pay for this.

As the Globe and Mail said:

The banks won’t lose. Only Ottawa will. It’s too late to do anything about those insurance policies now—we’re on the hook. But it’s not too late for Mr. Flaherty to show up at the CMHC board with a new set of orders: Shrink it.

Of course the Conservatives, despite having no love for the CMHC, panicked and doubled the size of it when the 2008 crisis hit. So they have to shoulder a big part of the blame.

I have always said - Government should strive to provide it's citizens with affordable housing. It should not place risk on future generations to allow everyone to own a home. In fact, by trying to do so, it may be making housing much less affordable for renters AND buyers.

Please vote in the poll folks...