OK - this post isn't what you think. Housing is not ready for the big drop yet.

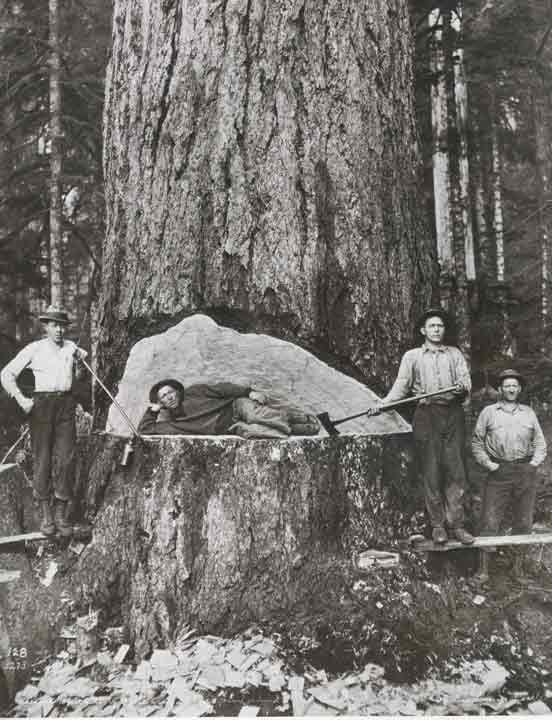

OK - this post isn't what you think. Housing is not ready for the big drop yet.This coast used to be known for it's old growth of gigantic Douglas fir. They rose high into the sky, as far as the eye could see. They looked like they touched the sky.

To log one of these trees required great expertise and courage. Loggers were veritable mechanical engineers, able to judge what type of cut would bring down this huge edifice where they wanted it, without harming themselves or others.

It required a complex series of cuts first on the side that the tree was to be felled and then on other side.

Loggers actually stood on stakes driven into the tree to help them. The tree was solid and would not fall despite being cut nearly half way through on one side and nearly a third on the other. Suddenly, with one more chop, it would happen! The weight would shift towards the fell side and the tree would start splintering and like a colloses it would crash to the ground.

It could get caught in another tree, but often this was just temporary. It would often bring that tree down with it too.

So we go in RE.

The cuts have been made. Incredible lack of affordability. All time lows in rates. CHMC changes. We are waiting to see when the tree will be felled.

Think 2007/2008.

We had a gradually worsening economy..no big deal. We had the bankruptcy of one the US'd largest investment companies..our RE hits new highs. We had the US in a full-scale RE collapse...yawn.

Then we had a rising inventory...hmm. Price changes out-numbering sales..sweaty arm-pits. MOI started to sky-rocket into the double digits and then over a year..nausea time. Then it suddenly fell.

Dropping 15% or so in a matter of months.

The CHMC shenanigans, the zero interest rates and the boom in Chinese RE were the tree that snagged it up and kept it from having a good roll-over. These are breaking down.

All eyes on inventory, MOI and price changes.